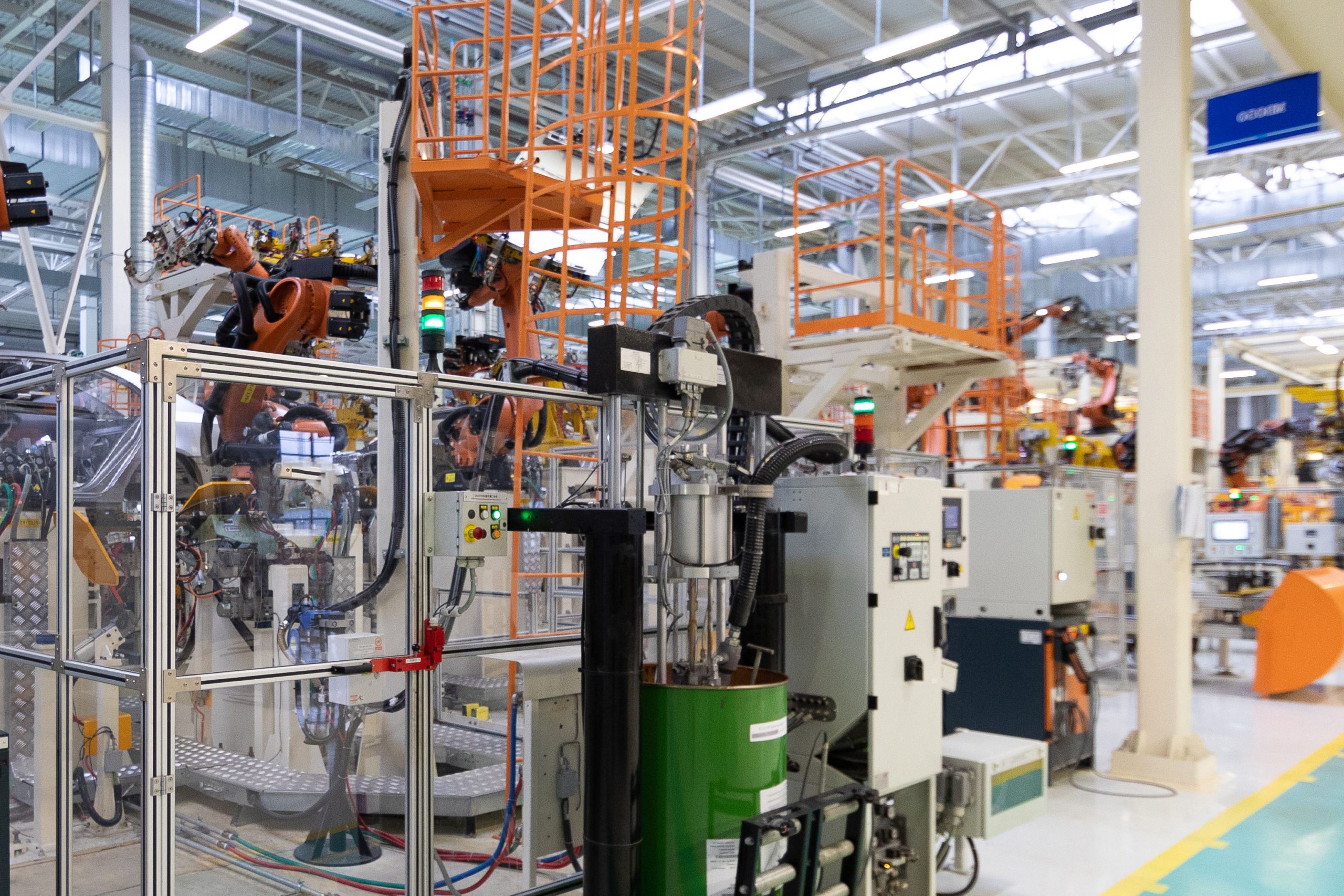

Construction & Infrastructure

Having an expert construction accountant is essential to the success of your business. The construction industry has some unique accountancy and tax requirements. Our experience means that when you work with us, we can get on with supporting and advising you, as we already understand what you need.

Our current building and construction clients range from contractors and tradespeople to family-owned businesses and large construction firms. Our team of experts can help you to protect your business and keep on top of the industry’s common requirements

If you’re looking for a construction accountant or a sub-contractor accountant, you’re looking for an accountancy firm that has an in-depth knowledge of the specific challenges your industry presents.

Sub-contractor accounting is complex – you are running your own limited company, which is tricky enough, and then you have CIS to consider on top of that. You want a specialised CIS accountant, equipped to deal with the complex tax system you find yourself in.

We can take care of your contractor and subcontractor registration, handle subcontractor verification and help you to prepare your monthly CIS returns. You can also take advantage of our complete range of accounting and taxation services all under one roof.

Hi, I’m Grant the Construction sector

expert here at Burgis & Bullock

If you need assistance then I’d love to help

you! Simply click below to get in touch

with me today

Specialist Services

for the Construction Sector

We take a proactive approach with clients offering strategic advice based on our leading-edge knowledge of the industry, and the latest developments in regulation and legislation. With our experience and sector knowledge we will add value to your construction business and work with you to achieve your business and personal goals.

Compliance Services

- Statutory accounts and returns

- Statutory Audits

- Corporate Taxation

- Partnership taxation

- Personal taxation

- Payroll and Autoenrolment pensions

- VAT returns and submissions

- Company secretarial services

- Outsourced bookkeeping

- Credit control services

- Cloud accounting and integrated App advice

- Advice on accounting software; including Cloud

Tax planning and advisory

- VAT planning & consultancy

- CIS advice and assistance

- Super Deduction, AIA and other capital allowances advice

- Corporate and personal tax planning

- Effective business and group structures

- IHT and business property relief planning

- Use of Trusts and family wealth protection

- Partial Exemption, Annual Adjustments and Capital Goods Scheme advice

- Making Tax Digital compliance

Business Support

- Staff incentive schemes including share option arrangements including the Enterprise Management Incentive (EMI) option schemes

- Enterprise Investment Scheme (EIS)

- Financing, budgeting & cash flow

- Management reporting and financial analysis

- Financial Planning advice on pensions and investments

- Virtual Finance Director services

- Reviewing internal controls procedures and business processes to maximise efficiency and to deter fraud.

- Raising Finance or restructuring debt and equity

- Project accounting and management reporting

There’s lots more ways we can help, take a look at all of our services

Discover more ![]()

Not what you need?

Check out the other specialist sectors we help here…