SORP 2026 is here – and it’s changing the way charities report. We’re kicking off our series with the section that sets the tone: the Trustees’ Report.

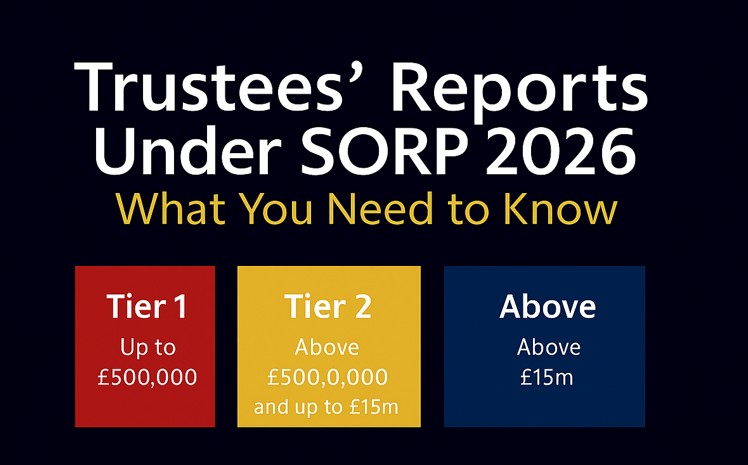

Before we dig into the detail though we will revisit the somewhat new tier system, as this is critical to determining how the changes will apply to your charity.

- Tier 1 – those with gross income up to £500,000

- Tier 2 – those with gross income above £500,000 and up to £15m

- Tier 3 – those with gross income above £15m

It’s no surprise the bigger the income, the more that needs to be disclosed.

They key changes for the trustee’s report section include the following:

Volunteers

To reflect on a contribution that is not recognised in the financials all charities must now include an explanation to help the reader understand the scale and nature of the activities undertaken by different volunteer roles. And if your charity is of tier 2 or 3 it should also provide information on the number of volunteers for that year, and an explanation of the activities they undertook to support the charity.

Achievements and performance

More clarity has been provided on what is expected to be included under the summary of the main achievements of the charity, with the SORP suggesting that the following questions should be considered by trustees of all charities in preparing their report

In what way has the charity’s work made a difference to the circumstances of its beneficiaries?

Has the charity’s work provided any wider benefits to society as a whole?

The standard also goes onto say that the use of infographics, statistics, and beneficiary/volunteer testimonials may help communicate this information to users. We do all love a good graph!

For charities falling under tier 2 further examples have been provided to aid the trustees in explaining how well the charity carried out its activities, and the extent to which the achievements in the reporting period met the aims and objectives set by the charity for that reporting period.

The SORP suggests the inclusion of the following may be useful:

- a summary of the measures or indicators used to assess performance (including in relation to environmental or social issues, if applicable)

- an explanation of the outputs achieved by particular activities especially when numerical targets have been set (for example, the number of beneficiaries to be reached by a particular programme, or the number of events or interventions planned as part of an activity)

- information on activities, outputs, and outcomes (or impacts) in the context of how they have contributed to the achievement of the charity’s aims and objectives

Sustainability

For those charities in tier 1 and 2 trustees may choose to explain how the charity is responding to and managing environmental, governance and social matters, but tier 3 does not get away so lightly.

For a tier 3 charity the report must provide a summary of how the charity is responding to and managing environmental, governance and social matters. This could include details of KPIs used to assess progress when managing climate related risks.

The report may also include details of privacy, cyber security, data security and business ethics to address governance, whilst social matters may include information on employee engagement and wellbeing, board diversity and inclusion and how a charity supports its local community.

Financial review

The requirements have been firmed up in respect of the discussion on reserves with all charities now being required to discuss the amount of reserves held against the charity’s reserves policy. Where reserves held are not in line with the policy details must be provided regarding the steps the charity is taking, given their plans for the future activities of the charity, to bring the level of reserves it holds into line with the policy.

Any material designated reserves must have their purpose explained and the likely timing of expenditure of these funds detailed.

If a charity has no reserves (or negative net assets on the balance sheet), it must also explain why it is still operating as a going concern.

In addition, for the tier 2 and tier 3 charities narrative on how legacies are recognised in the accounts should be provided. Specifically, the impact of any material legacy income recognised in the accounts prior to the funds or property actually being received. This should help readers of the accounts understand the effect timing differences may have on resources available to the charity.

Next time we will start delving into how the new SORP could alter the numbers in the accounts, so please watch this this space for more.

Need help with preparing for SORP 2026?

Contact your usual team member at Burgis & Bullock https://www.burgisbullock.com/contact-us/

making tax digital for income tax

making tax digital for income tax